We are the business

behind business®.

Driven by a fierce client spirit, market-leading expertise, and unmatched global reach, we power every stage of the business life cycle.

When you need to stay compliant,

we provide the clarity you need.

We've got you.

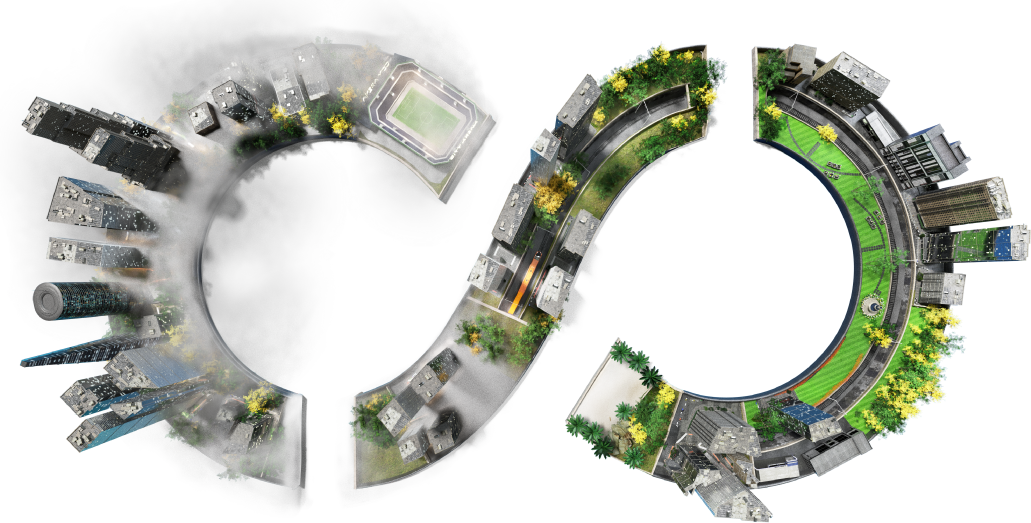

A Unified Brand.

An Unwavering Commitment.

Our CSC brand symbolizes the collective strength of our employees, who provide solutions in more than 140 jurisdictions. It also highlights three very crucial elements—our clients, our partners, and our communities. We remain tirelessly committed to fostering and maintaining our relationships, to doing the right thing, and to always delivering the expertise, service, and global capabilities our clients and partners deserve.

Our Expertise and Scale

Trusted partner of choice for:

of the Fortune 500®

of the 100 Best

Global Brands

(Interbrand®)

of the PEI 300

law firms

Expertise and capabilities in more than 140 jurisdictions

World-class NPS scores

Award-winning solutions

Leading Insights

Locations

We are a truly integrated network across the globe. No franchises or affiliates—just CSC offices delivering the same levels of consistently exceptional service, wherever and whenever you need us.